The rapid growth of unsecured loans has affected the stocks of One97 Communications, the company that operates under the brand name Paytm in the financial services sector. This company was listed on the stock market in November 2021 at an issue price of Rs. 2,150. However, its share price plummeted to Rs. 472 in November 2022, leading to a market value decline of over Rs. 100,000 crores. In recent times, the company has shown improvement in its performance, consistently earning operating profits for the past four quarters excluding ESOP costs. A significant factor in this improvement has been the remarkable growth in its lending vertical. The stock price has rebounded from Rs. 470 in November to Rs. 875. Nonetheless, the Reserve Bank of India’s decision to increase risk weights on unsecured loans raises concerns about Paytm’s future growth. This poses the question: will the RBI’s move make the path ahead difficult for Paytm? Understanding Paytm’s journey is crucial to answering this question. Presently, after Bajaj Finance, it stands as the second-largest acquisition platform for unsecured credit customers.

Good Growth in Financial Services

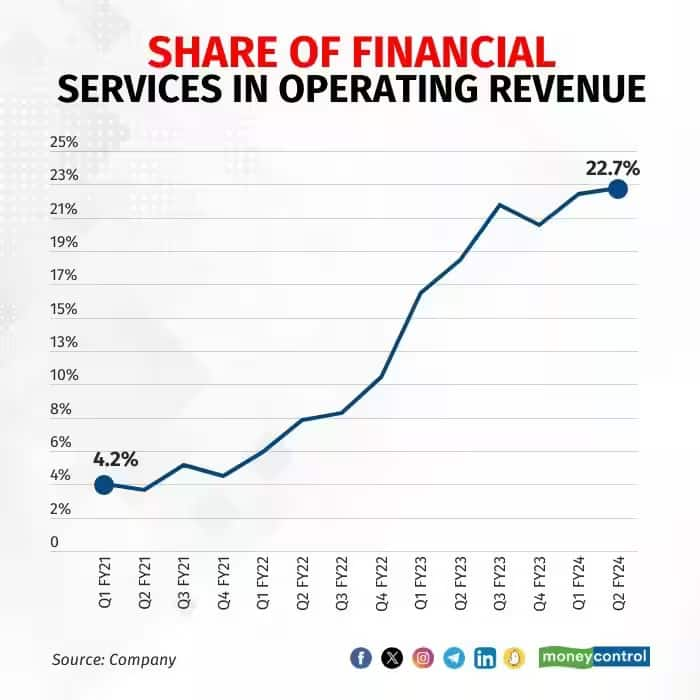

In the second quarter of this financial year, Paytm’s share in financial services revenue stood at 23%, marking a considerable improvement compared to 18% in the same period of the previous fiscal year. In FY21, this share was a mere 3.8%. This signifies robust growth in Paytm’s financial services. There has been a decline in loans disbursed through Paytm’s platform in September this year, predating the RBI’s increase in risk weights on unsecured loans. This indicates Paytm’s lending business relies heavily on bank and NBFC growth.

Impact since the UPI’s Inception

There’s an anticipation that banks and NBFCs might adopt stringent measures in lending post the implementation of RBI’s new risk weight rules. This could affect Paytm, leading to a potential decrease in loan disbursal and affecting the fees earned from partner banks. This isn’t the first instance of challenges for Paytm. Previously, since the inception of UPI, its wallet business took a significant hit. Consequently, the company might need to focus on new products/strategies rather than solely relying on its lending vertical.

Big Investors Have Sold Their Shares

Paytm offers payment solutions to consumers and merchants under its business model. Alongside high-margin financial services, it also offers cloud services. In this context, the company’s lending business becomes crucial in terms of valuation. While the payment business is paramount for Paytm, the lending business plays an essential role in supporting it. Therefore, RBI’s recent move is not ideal for Paytm’s growth. Recently, Berkshire Hathaway sold its entire 2.5% stake in Paytm. After holding the stake for five years, it divested it at a loss.

Not an Easy Road for Growth

Paytm’s valuation now appears to be at the right level compared to earlier. Its revenue is 5.5 times higher in FY25. At the time of the IPO, it was expected to grow 13.4 times in one year. Despite this, there doesn’t seem to be much excitement in Paytm’s stock, as the company faces several challenges. Additionally, the impact of major investors selling their shares could affect it. However, inclusion in MSCI may provide some support to its stock prices. We anticipate weak performance from this stock, so investors need to exercise caution.