Mutual funds have gained immense popularity among investors due to their potential for diversification, professional management, and ease of access. These investment vehicles offer a wide array of options to cater to different investment goals, risk appetites, and time horizons. In this blog, we will dive into the various types of mutual funds available in the market, shedding light on their unique characteristics and benefits.

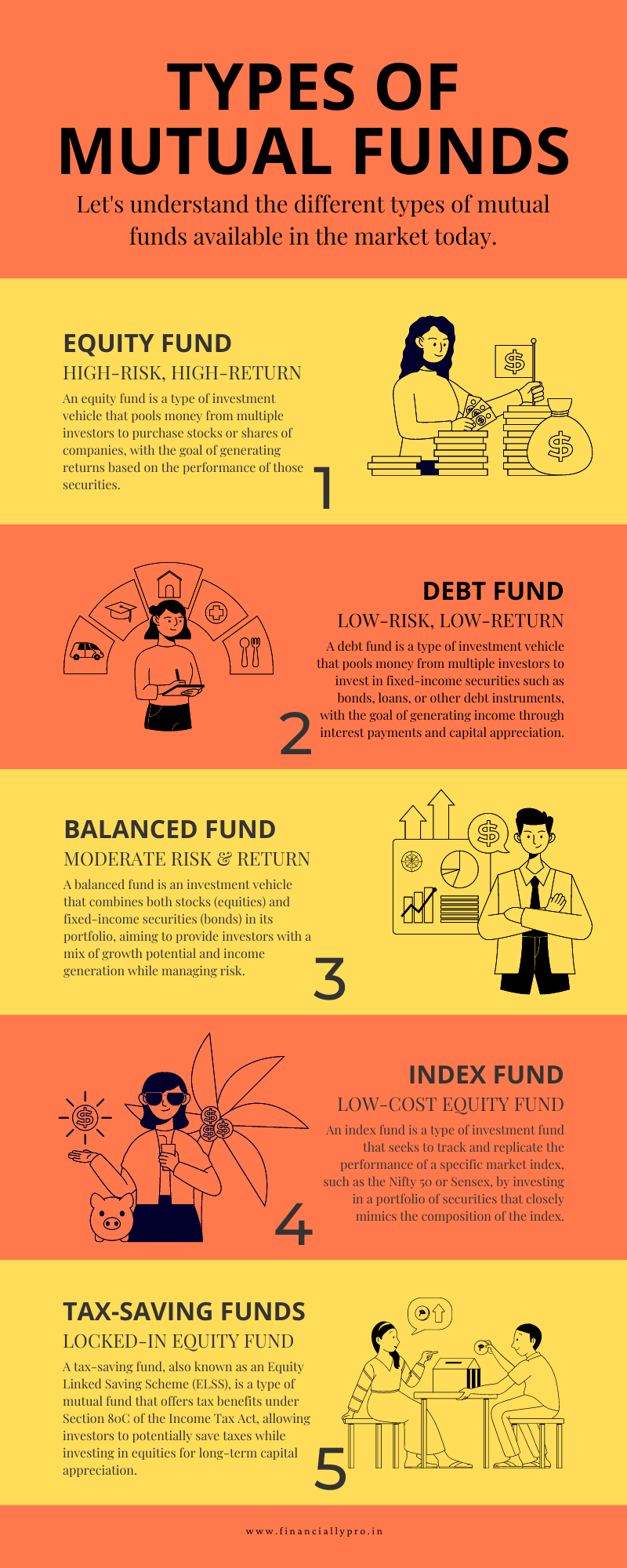

Equity Mutual Funds

Equity funds are a type of mutual fund that primarily invests in stocks or equity-related securities of companies. These funds aim to generate capital appreciation over the long term by investing in a diversified portfolio of equities. Here are some key points to understand about equity funds:

- Objective: The primary objective of equity funds is to provide growth by investing in shares of companies across various sectors and market capitalizations.

- Risk and Returns: Equity funds carry a higher level of risk compared to debt funds or money market funds due to the volatility of the stock market. However, they also have the potential to deliver higher returns over the long term.

- Diversification: Equity funds offer diversification by investing in a wide range of stocks. This diversification helps reduce the impact of individual stock price movements on the overall portfolio.

- Investment Styles: Equity funds can follow different investment styles, such as value investing, growth investing, or a blend of both. Value-oriented funds look for undervalued stocks, while growth-oriented funds focus on companies with high growth potential.

- Market Capitalization: Equity funds can be categorized based on the market capitalization of the companies they invest in. These categories include large-cap, mid-cap, and small-cap funds. Large-cap funds invest in well-established companies with large market capitalizations, while mid-cap and small-cap funds focus on mid-sized and smaller companies, respectively.

- Active vs. Passive Management: Equity funds can be actively managed, where fund managers make decisions based on their analysis and research, or passively managed, such as index funds that aim to replicate the performance of a specific market index.

- Dividends: Some equity funds distribute dividends to investors based on the profits earned by the underlying companies. Dividend payout frequency can vary among funds.

- Long-Term Investment Horizon: Equity funds are generally recommended for investors with a long-term investment horizon of five years or more. They are suited for those willing to withstand short-term market fluctuations to potentially benefit from long-term market growth.

- SIP (Systematic Investment Plan): Investors can invest in equity funds through SIPs, where a fixed amount is invested at regular intervals. SIPs help in rupee-cost averaging and disciplined investing.

- Taxation: Equity funds held for more than one year qualify for long-term capital gains tax, which is currently taxed at a favorable rate. However, short-term capital gains (investments held for one year or less) are subject to higher tax rates.

Debt Mutual Funds

Debt funds are a type of mutual fund that primarily invests in fixed-income securities, such as government bonds, corporate bonds, debentures, and money market instruments. Here are some key points to understand about debt funds:

- Objective: The primary objective of debt funds is to generate income and preserve capital by investing in fixed-income securities. These funds aim to provide stable and regular returns to investors.

- Risk and Returns: Debt funds are generally considered to have lower risk compared to equity funds. The risk levels vary based on the type of debt securities held in the portfolio. Government securities are considered less risky, while corporate bonds carry slightly higher risk.

- Investment Grade: Debt funds typically invest in investment-grade securities, which are considered to have a lower risk of default. These securities are assigned credit ratings by rating agencies, such as CRISIL, CARE, or ICRA, indicating their creditworthiness.

- Duration and Maturity: Debt funds can have different durations and maturities. Duration refers to the sensitivity of the fund’s portfolio to changes in interest rates. Short-duration funds have lower interest rate risk, while long-duration funds are more sensitive to interest rate movements.

- Yield and Income: Debt funds generate income primarily through interest payments received from the underlying fixed-income securities. The income earned is passed on to investors in the form of dividends or capital appreciation.

- Liquidity: Debt funds generally offer high liquidity, allowing investors to buy or sell units on any business day. However, certain categories like Fixed Maturity Plans (FMPs) have a fixed maturity period and are not open-ended.

- Taxation: Debt funds held for less than three years are subject to short-term capital gains tax, which is added to the investor’s taxable income and taxed at their applicable income tax rate. Debt funds held for more than three years qualify for long-term capital gains tax, with indexation benefit available to reduce tax liability.

- Credit Risk: Debt funds carry credit risk, which refers to the risk of default by the issuer of the debt securities. Funds that invest in lower-rated or unrated securities may have higher credit risk compared to funds investing in high-rated securities.

- Expense Ratio: Debt funds have an expense ratio that covers the fund’s management and operational expenses. Investors should consider the expense ratio while evaluating the fund’s overall returns.

- Interest Rate Risk: Debt funds are sensitive to changes in interest rates. When interest rates rise, bond prices tend to fall, affecting the net asset value (NAV) of the fund. Conversely, when interest rates decline, bond prices tend to rise, positively impacting the fund’s NAV.

Hybrid Mutual Funds

Balanced funds, also known as hybrid funds, are a type of mutual fund that aim to provide a balance between growth and income by investing in a mix of equity and debt instruments. Here are some key points to understand about balanced funds:

- Objective: The primary objective of balanced funds is to generate both capital appreciation and income by investing in a combination of equity and debt securities.

- Asset Allocation: Balanced funds maintain a predetermined asset allocation between equity and debt instruments. The allocation can vary depending on the fund’s investment strategy and market conditions. Generally, these funds have a higher allocation to equity (around 65-75%) and a lower allocation to debt (around 25-35%).

- Diversification: Balanced funds offer diversification by investing in a mix of equities and debt instruments. This diversification helps reduce the overall risk of the portfolio and provides potential for stable returns.

- Risk and Returns: Balanced funds tend to have a moderate risk profile compared to pure equity funds. The equity component provides growth potential, while the debt component offers stability and income generation. The risk and returns of balanced funds can vary based on the underlying asset allocation.

- Investment Styles: Balanced funds can follow different investment styles, such as value investing, growth investing, or a combination of both. The fund manager’s investment approach determines the selection of equity and debt securities within the portfolio.

- Dividends and Interest Income: Balanced funds may distribute dividends and interest income generated by the underlying securities to investors. The frequency and amount of distributions depend on the fund’s performance and distribution policy.

- Asset Class Performance: The performance of balanced funds is influenced by the performance of both equity and debt markets. If equity markets perform well, the fund’s returns may be driven by capital appreciation. Conversely, in times of market volatility, the debt component provides stability to the overall returns.

- Risk Profile: Balanced funds are suitable for investors with a moderate risk appetite, seeking a balanced approach to capital appreciation and income generation. These funds are often considered as a one-stop solution for investors looking for diversification across asset classes.

- Taxation: The tax treatment of balanced funds depends on the asset allocation and holding period. The equity component of the fund is subject to capital gains tax, while the debt component may attract tax on interest income. Long-term capital gains on equity investments are currently taxed at a favorable rate.

- SIP (Systematic Investment Plan): Investors can invest in balanced funds through SIPs, where a fixed amount is invested at regular intervals. SIPs help in rupee-cost averaging and disciplined investing.

Money Market Funds

Money market funds are a type of mutual fund that invests in low-risk, short-term debt instruments. These funds aim to provide investors with stability, liquidity, and preservation of capital. Here are some key points to understand about money market funds:

- Objective: The primary objective of money market funds is to provide a safe and liquid investment option with modest returns. These funds focus on preserving capital while generating income.

- Investments: Money market funds invest in short-term debt instruments, such as Treasury bills, commercial paper, certificates of deposit, and repurchase agreements. These instruments have short maturities and high credit quality.

- Low Risk: Money market funds are considered low-risk investments due to the short-term nature of the underlying securities and the focus on high-quality issuers. However, it’s important to note that they are not risk-free.

- Stability and Liquidity: Money market funds aim to maintain a stable net asset value (NAV) of ₹1 per unit. Investors can generally redeem their units at any time, providing high liquidity.

- Returns: Money market funds generate income primarily through interest earned on the underlying debt instruments. Returns are typically modest compared to equity or bond funds but higher than traditional savings accounts or fixed deposits.

- Capital Preservation: Money market funds focus on preserving the invested capital by investing in low-risk instruments. These funds are suitable for investors who prioritize capital protection and short-term cash management.

- Investment Horizon: Money market funds are suitable for investors with a short investment horizon or those who require immediate access to their funds.

- Expense Ratio: Money market funds have an expense ratio that covers the fund’s management and operational expenses. The expense ratio tends to be relatively low compared to other mutual fund categories.

- Taxation: Gains from money market funds are subject to taxation based on the investor’s income tax slab. Short-term capital gains (investments held for less than three years) are taxed at the investor’s applicable income tax rate.

- Stability and Regulatory Oversight: Money market funds are regulated by the Securities and Exchange Board of India (SEBI). Regulations aim to ensure stability, liquidity, and safety for investors.

Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aim to replicate the performance of a specific market index, such as the Nifty 50 or BSE Sensex. Here are some key points to understand about index funds:

- Objective: The primary objective of index funds is to provide investors with broad market exposure and a return that closely tracks the performance of a specific market index.

- Passive Management: Index funds follow a passive investment strategy, meaning they do not actively pick stocks or time the market. Instead, they aim to replicate the holdings and weightings of the underlying index.

- Index Replication: Index funds replicate the performance of an index by investing in the same securities and in the same proportions as the index. For example, if a stock represents 5% of the index, the fund will hold a 5% allocation of that stock.

- Diversification: Index funds offer inherent diversification as they hold a large number of securities representing the index. This diversification helps reduce the risk associated with individual stocks.

- Lower Expense Ratios: Index funds tend to have lower expense ratios compared to actively managed funds. Since they do not require extensive research or active management, the costs associated with running the fund are generally lower.

- Market Returns: Index funds aim to deliver returns that closely mirror the overall market performance represented by the index they track. The objective is to capture the broad market trends rather than outperforming the market.

- Transparency: Index funds provide transparency as the holdings of the fund are publicly disclosed. Investors can easily know the composition of the portfolio and the securities held by the fund.

- Broad Market Exposure: Index funds can cover different asset classes and market segments, including equity indices, bond indices, and international indices. This allows investors to diversify their portfolios across various markets.

- Lower Turnover: Index funds typically have lower portfolio turnover compared to actively managed funds. This results in fewer transaction costs and potentially lower tax implications for investors.

- Long-Term Investing: Index funds are well-suited for long-term investors who prefer a passive investment approach and are comfortable with market returns rather than seeking to beat the market.

Sector Funds

Sector funds are a type of mutual fund that focuses on investing in stocks of companies operating within a specific sector or industry. These funds aim to capitalize on the potential growth and performance of a particular sector. Here are some key points to understand about sector funds:

- Objective: The primary objective of sector funds is to provide investors with targeted exposure to a specific sector or industry. These funds focus on capitalizing on the growth and potential of a particular sector.

- Sector Concentration: Sector funds have a concentrated portfolio, primarily consisting of stocks from companies operating within a specific sector. The portfolio may include companies of varying market capitalizations within the chosen sector.

- Risk and Return: Sector funds tend to carry higher risk compared to diversified funds that invest across multiple sectors. The performance of sector funds is closely tied to the performance of the underlying sector. If the sector performs well, the fund can deliver significant returns, but if the sector faces challenges, the fund’s performance may suffer.

- Investment Strategy: Sector funds can adopt different investment strategies, including active management or passive management (such as tracking a sector-specific index). Active sector funds rely on the expertise of fund managers to select stocks within the sector, while passive sector funds aim to replicate the performance of a sector index.

- Cyclical and Defensive Sectors: Sector funds can focus on either cyclical or defensive sectors. Cyclical sectors, such as technology, consumer discretionary, or real estate, tend to be more sensitive to economic cycles. Defensive sectors, such as healthcare, utilities, or consumer staples, are considered less affected by economic fluctuations.

- Industry Insights: Sector funds require investors to have a good understanding of the sector they are investing in. Investors should stay informed about industry trends, regulatory changes, and market dynamics affecting the specific sector.

- Diversification: Investing in sector funds should be approached with caution as they lack diversification across sectors. Holding a sector fund alongside a well-diversified portfolio can help mitigate concentration risk.

- Performance Volatility: Sector funds can be subject to higher performance volatility due to their concentrated exposure. The fund’s performance may be more pronounced during market upswings or downturns, depending on the performance of the underlying sector.

- Timing and Sector Rotation: Investors considering sector funds may need to time their entry and exit points based on their views on sector performance. Sector rotation involves shifting investments from one sector to another based on market or economic conditions.

- Risk Management: Investors should carefully evaluate their risk tolerance and consider sector funds as part of a well-diversified investment strategy. It is advisable to review the fund’s historical performance, expense ratio, and consult with a financial advisor to assess suitability and align with investment goals.

Tax-Saving Funds (ELSS)

Tax-saving funds, also known as Equity Linked Savings Schemes (ELSS), are a specific category of mutual funds in India that offer tax benefits under Section 80C of the Income Tax Act. Here are some key points to understand about tax-saving funds (ELSS):

- Tax Benefits: ELSS funds offer tax benefits by allowing investors to claim deductions up to ₹1.5 lakh in a financial year under Section 80C of the Income Tax Act. The amount invested in ELSS qualifies for the deduction, thereby reducing the investor’s taxable income.

- Equity Investments: ELSS funds primarily invest in equity and equity-related instruments. These funds provide investors with an opportunity to participate in the potential growth of the stock market.

- Lock-in Period: ELSS funds have a mandatory lock-in period of three years, which is the shortest lock-in period among tax-saving investment options under Section 80C. The lock-in period starts from the date of each investment.

- Potential for Capital Appreciation: As ELSS funds invest in equities, they have the potential to generate capital appreciation over the long term. The performance of the fund is linked to the performance of the stock market.

- Diversification: ELSS funds typically have a diversified portfolio of stocks across different sectors and market capitalizations. This diversification helps spread the risk associated with individual stocks.

- SIP (Systematic Investment Plan): Investors can invest in ELSS funds through SIPs, which allows them to invest a fixed amount at regular intervals. SIPs help in rupee-cost averaging and disciplined investing.

- Taxation: ELSS funds have a unique tax treatment. Long-term capital gains (investments held for more than one year) up to ₹1 lakh are exempt from tax, while gains above ₹1 lakh are subject to a 10% tax. Dividends received from ELSS funds are tax-free in the hands of the investor.

- Risk and Returns: ELSS funds are equity-oriented investments and are subject to market risk. The returns and risks associated with ELSS funds depend on the performance of the underlying stocks in the portfolio.

- Flexibility: ELSS funds offer flexibility in terms of investment amounts and fund selection. Investors can choose from various ELSS funds based on their risk appetite and investment goals.

- Wealth Creation and Tax Saving: ELSS funds not only provide potential wealth creation through equity exposure but also offer tax savings. They are suitable for investors who have a long-term investment horizon and are willing to accept the risks associated with equity investments.

Exchange-Traded Funds (ETF)

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, similar to individual stocks. Here are some key points to understand about ETFs:

- Structure: ETFs are investment funds that pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, commodities, or a combination thereof.

- Listed on Exchanges: ETFs are traded on stock exchanges, allowing investors to buy and sell ETF shares throughout the trading day at market prices. They can be bought and sold through brokerage accounts, just like individual stocks.

- Passive and Active Management: ETFs can follow a passive or active investment strategy. Passive ETFs aim to replicate the performance of a specific market index or benchmark. Active ETFs are actively managed by investment professionals who make investment decisions to outperform the market.

- Diversification: ETFs offer investors exposure to a diversified portfolio of securities or assets. This diversification helps spread risk and provides access to various market sectors, industries, or asset classes.

- Transparency: ETFs provide transparency as their holdings are disclosed on a regular basis, allowing investors to know the underlying assets and their respective weightings. This transparency helps investors make informed investment decisions.

- Liquidity: ETFs are highly liquid, as they can be bought or sold on stock exchanges throughout the trading day. The liquidity is provided by the creation and redemption process, where authorized participants create or redeem ETF shares in large blocks based on investor demand.

- Lower Costs: ETFs typically have lower expense ratios compared to traditional mutual funds. Passive ETFs, in particular, tend to have lower costs since they aim to replicate the performance of an index rather than actively managed strategies.

- Flexibility: ETFs offer flexibility in terms of trading. Investors can place limit orders, stop orders, and even short sell ETF shares. They also have the flexibility to invest in specific market sectors, industries, or asset classes through specialized ETFs.

- Tax Efficiency: ETFs are generally tax-efficient due to their unique structure. Authorized participants can create or redeem ETF shares “in-kind,” which can help minimize capital gains distributions. Additionally, investors have control over when to realize capital gains or losses by choosing when to buy or sell their ETF shares.

- Global Exposure: ETFs provide opportunities for global investment exposure. Investors can access international markets and gain exposure to foreign equities or bonds through global or country-specific ETFs.

GILT Funds

Gilt funds are a type of mutual fund that primarily invests in government securities, also known as gilts. Here are some key points to understand about gilt funds:

- Government Securities: Gilt funds invest in fixed-income securities issued by the government, such as central government bonds, treasury bills, and state government bonds. These securities are considered to have the highest credit quality and low default risk.

- Income Generation: Gilt funds aim to generate income for investors through interest earned on the government securities in their portfolio. The interest payments received by the fund and any capital appreciation from changes in interest rates contribute to the fund’s returns.

- Safety and Stability: Government securities are considered to be among the safest investment instruments, as they are backed by the government. Gilt funds offer stability in terms of capital preservation, making them suitable for conservative investors seeking lower risk investments.

- Interest Rate Sensitivity: Gilt funds are highly sensitive to changes in interest rates. When interest rates rise, the prices of existing fixed-income securities in the fund’s portfolio tend to decline, impacting the fund’s net asset value (NAV). Conversely, falling interest rates can lead to price appreciation.

- Diversification: Gilt funds provide diversification benefits by investing in a portfolio of government securities across various maturities and issuers. This diversification helps reduce the risk associated with individual securities or issuers.

- Capital Gains and Losses: Gilt funds can generate capital gains or losses when the prices of the securities in the portfolio change due to interest rate movements. These gains or losses are reflected in the fund’s NAV and may impact the returns received by investors.

- Duration and Yield: Gilt funds have specific duration and yield characteristics based on the average maturity of the securities in their portfolio. Longer-duration funds tend to be more sensitive to interest rate changes and may offer higher yields, while shorter-duration funds provide lower interest rate risk and lower yields.

- Liquidity: Gilt funds offer liquidity to investors, allowing them to buy or sell units at the prevailing NAV. However, it’s important to note that the liquidity of gilt funds can vary depending on market conditions and the availability of buyers and sellers in the market.

- Risk Factors: Although government securities are generally considered low-risk investments, gilt funds are not entirely risk-free. They are subject to interest rate risk, credit risk (if investing in state government bonds), and liquidity risk. Investors should assess their risk tolerance and carefully consider these risks before investing.

- Taxation: Gilt funds are subject to taxation based on the holding period of the units. Short-term capital gains (investments held for less than three years) are taxed at the investor’s applicable income tax rate, while long-term capital gains (investments held for more than three years) are taxed at a flat rate of 20% with indexation benefits.

Fund of Funds

Fund of Funds (FoFs) are investment vehicles that invest in other mutual funds or collective investment schemes rather than directly investing in individual securities. Here are some key points to understand about Fund of Funds:

- Diversification: FoFs offer diversification by investing in a portfolio of different mutual funds across asset classes, investment styles, or geographic regions. By holding multiple funds, FoFs provide exposure to a broader range of investment opportunities, spreading the risk associated with investing in a single fund.

- Asset Allocation: FoFs can be designed to allocate investments across various asset classes such as equities, bonds, commodities, or alternative investments. They can also allocate funds to different types of funds, such as equity funds, debt funds, index funds, or sector-specific funds.

- Professional Management: FoFs are managed by experienced fund managers or investment professionals who perform research and analysis to select and manage the underlying mutual funds. The managers aim to construct a portfolio of funds that aligns with the investment objectives of the FoF.

- Convenience: FoFs offer convenience to investors as they can gain exposure to multiple mutual funds through a single investment. This can be particularly helpful for investors who may not have the time, expertise, or resources to individually select and manage multiple funds.

- Risk and Return: The risk and return profile of FoFs depend on the underlying mutual funds in which they invest. The performance of the FoF will be influenced by the performance of the underlying funds, asset allocation decisions, and the fund manager’s expertise.

- Expense Ratio: FoFs have their own expense ratio, which includes the fees charged by the underlying funds as well as the management fees of the FoF itself. It’s important to consider the cumulative expense ratio when evaluating the cost-effectiveness of investing in a FoF.

- Flexibility: FoFs provide flexibility as they can be structured to suit different investor preferences and risk appetites. They may offer different investment strategies, such as aggressive growth, balanced, or conservative, allowing investors to choose a FoF that aligns with their investment goals.

- Taxation: FoFs are subject to taxation based on the underlying mutual funds’ investments. Investors should be aware of the tax implications and consult with a tax advisor to understand the tax treatment specific to their country and investment circumstances.

- Suitability: FoFs can be suitable for investors who prefer a diversified investment approach without the need for active management of individual funds. They can be beneficial for investors seeking exposure to a specific asset class or those looking for a one-stop solution for their investment needs.

- Performance Monitoring: Investors should monitor the performance of FoFs, as their returns will depend on the performance of the underlying funds. Regular review and assessment of the FoF’s performance and the underlying funds are important to ensure they continue to meet investment objectives.

The world of mutual funds offers a diverse range of options to suit every investor’s needs and goals. By understanding the various types of mutual funds available, investors can make informed investment decisions aligned with their risk appetite, investment horizon, and financial objectives. It is crucial to carefully evaluate each fund’s investment strategy, historical performance, expense ratios, and risk factors before making investment choices. Consulting with a financial advisor can also provide valuable insights and guidance in selecting the most appropriate mutual funds for your investment portfolio.

FAQs related to types of Mutual Funds

Here are some frequently asked questions related to types of mutual funds in India:

What are the different types of equity funds in India?

Equity funds in India can be categorized based on market capitalization, such as large-cap funds, mid-cap funds, and small-cap funds. Additionally, there are sector-specific funds that focus on particular industries like technology, healthcare, banking, etc.

What are the types of debt funds available in India?

In India, debt funds can be classified based on the duration of the underlying bonds, such as liquid funds, short-term funds, medium-term funds, and long-term funds. They may also include categories like corporate bond funds, government bond funds, and gilt funds.

What are balanced funds and how do they work?

Balanced funds, also known as hybrid funds, invest in a mix of equity and debt instruments. These funds aim to strike a balance between capital appreciation and stability. The allocation between equity and debt may vary, and the fund manager adjusts the portfolio to maintain the desired asset allocation.

Can you explain index funds in India?

Index funds in India are designed to track a specific market index, such as the Nifty 50 or the Sensex. They invest in the same stocks in the same proportion as the index they replicate. Index funds provide broad market exposure and aim to deliver returns similar to the underlying index.

What are the characteristics of money market funds?

Money market funds in India invest in short-term, low-risk debt instruments. They offer stability and liquidity while aiming to preserve the principal amount. Money market funds are suitable for investors with a short investment horizon or those looking for a safe place to park their funds temporarily.

Are there any specialty funds available in India?

Yes, in India, there are specialty funds that focus on specific investment themes or sectors. Some examples include real estate funds, infrastructure funds, international funds, and thematic funds like technology funds or healthcare funds. These funds offer targeted exposure to specific areas and can provide diversification beyond traditional asset classes.

Which type of mutual fund is suitable for conservative investors?

Debt funds and balanced funds are generally considered suitable for conservative investors. Debt funds provide stable income with lower risk, while balanced funds offer a mix of income and growth potential while maintaining a moderate risk profile.

Are there any tax implications associated with different types of mutual funds in India?

Yes, different types of mutual funds in India may have varying tax implications. Equity funds held for more than one year qualify for long-term capital gains tax with indexation benefits. Debt funds held for more than three years also attract long-term capital gains tax. It’s advisable to consult a tax professional or refer to the latest tax laws for accurate information.

What is the difference between open-ended and closed-ended mutual funds?

Open-ended mutual funds do not have a fixed maturity date and allow investors to enter or exit the fund at any time. They offer liquidity and flexibility. Closed-ended mutual funds, on the other hand, have a fixed maturity period and investors can only buy or sell units during the initial offer period. After the offer period, the fund is listed on the stock exchange, and investors can trade units like shares.

What are tax-saving mutual funds or ELSS funds?

Equity Linked Saving Schemes (ELSS) are tax-saving mutual funds that offer tax benefits under Section 80C of the Income Tax Act in India. ELSS funds primarily invest in equities and have a lock-in period of three years. They provide an opportunity for capital appreciation along with the advantage of tax savings.

Can you explain the concept of a systematic investment plan (SIP)?

A systematic investment plan (SIP) is an investment strategy offered by mutual funds in India. It allows investors to invest a fixed amount regularly (monthly, quarterly, etc.) in a mutual fund scheme of their choice. SIPs promote disciplined investing, averaging out the cost of purchase, and reducing the impact of market volatility over time.

Are there any mutual funds specifically designed for retirement planning?

Yes, retirement mutual funds or pension plans are available in India. These funds are designed to help individuals accumulate a corpus for their retirement years. Retirement funds usually have a long-term investment horizon, aiming for capital appreciation with a gradual shift towards a more conservative portfolio as retirement approaches.

Can non-resident Indians (NRIs) invest in mutual funds in India?

Yes, NRIs are allowed to invest in mutual funds in India, subject to certain regulations. NRIs can invest in most mutual fund schemes, except for a few funds that may have specific restrictions. They can invest in mutual funds through NRE/NRO accounts and follow the necessary compliance requirements as per the regulations.

What are the expenses associated with mutual funds?

Mutual funds have certain expenses associated with them, such as expense ratios, entry loads (if applicable), and exit loads (for certain schemes). The expense ratio represents the annual expenses of managing the mutual fund and is expressed as a percentage of the average net assets. It covers administrative, management, and other operational costs.

How can I choose the right type of mutual fund for my investment goals?

Choosing the right type of mutual fund involves considering factors such as investment goals, risk tolerance, investment horizon, and personal financial circumstances. It is advisable to assess these factors and consult with a financial advisor who can provide personalized guidance based on your individual needs and objectives.